TalesFromFlorida.com Exclusive

Oh, Florida. Land of sunshine, alligators, and alleged financial shenanigans that would make even the most seasoned scammer blush. Meet Semiha Nilgun Gencsoy, a 71-year-old Fort Lauderdale woman who just proved that retirement fraud is the new Florida Woman hobby—right up there with wrestling gators and arguing with Publix cashiers over expired coupons.

The Setup: A Pension That Just Wouldn’t Quit

Gencsoy’s father, a former West Virginia University professor, retired in 1985 and, like all good things, passed away in 2007. His widow (Gencsoy’s mom) kept receiving his pension benefits—because bureaucracy moves slower than a Florida driver in the left lane. But when she died less than a year later, Gencsoy apparently thought, “Eh, why ruin a good thing?” and just… didn’t tell anyone.

The Grift: $328K in ‘Oops, My Bad’ Money

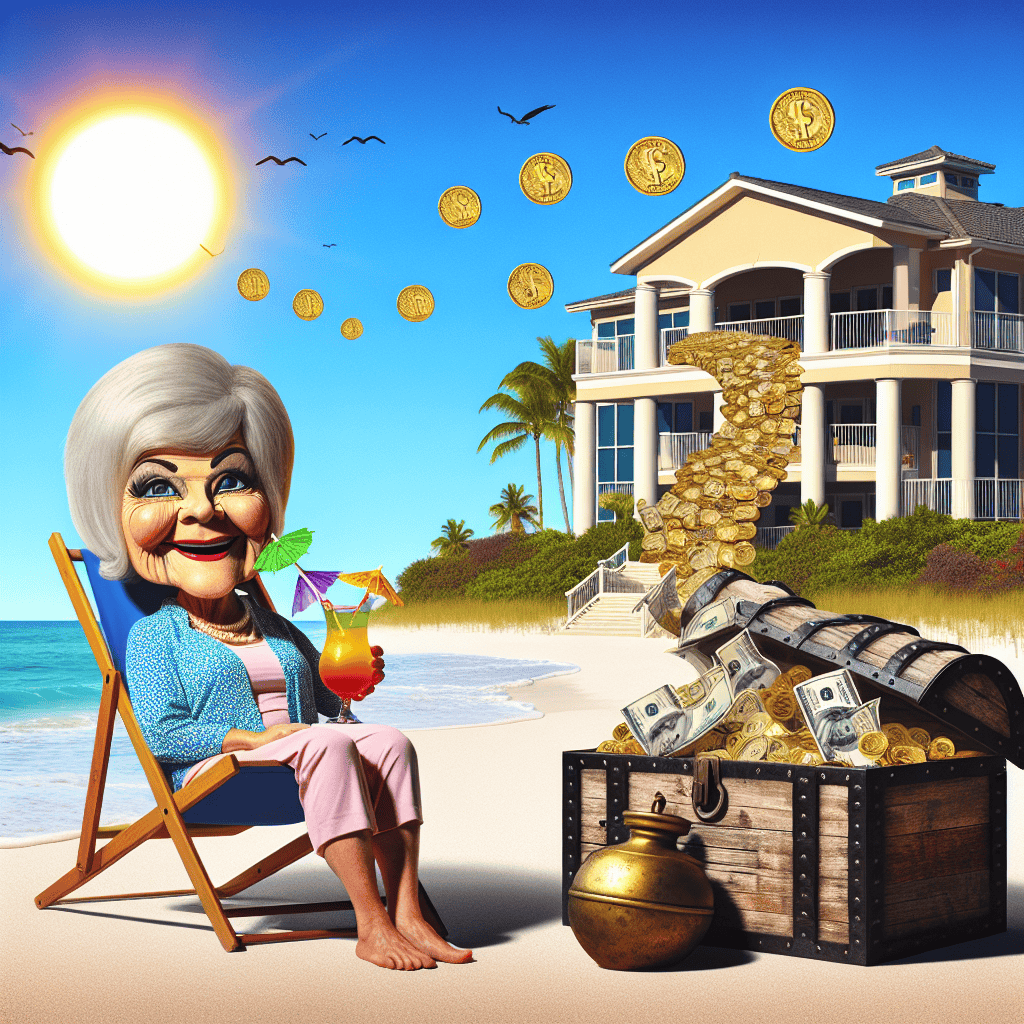

For 15 years, the West Virginia Consolidated Public Retirement Board kept depositing those sweet, sweet pension checks into a joint account Gencsoy shared with her late mother. And what did she do? Oh, just casually transferred $328,478 into her own account like it was her part-time job.

Her actual full-time job? Living her best life in a luxury beachfront condo worth over $1.1 million. Because nothing says “retirement fraud” like sipping margaritas with a view of the ocean, am I right?

The Fallout: ‘You Want Me to Pay It ALL Back?!’

After finally getting caught, Gencsoy pleaded guilty to receiving stolen goods (because, let’s be real, “Oops, I forgot my parents died” isn’t a legal defense). Now she’s facing up to 10 years in federal prison—which, let’s be honest, probably doesn’t have ocean views—and has to repay every single cent.

But hey, at least she got a solid decade and a half of free money before the party ended.

Stay shady, Florida. 🌴💸